You have just gotten a BRAND-new set of wheels. Congratulations!

The moment you drive that new vehicle off the car lot, it starts to depreciate in value. In fact, most cars lose 20 percent of their value within the first year.

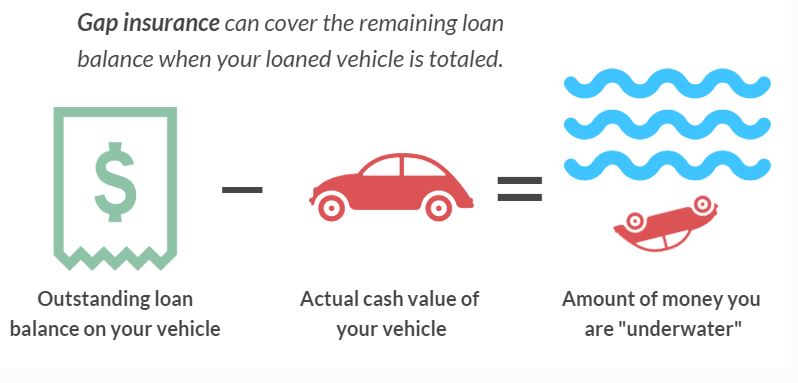

This can be a big financial problem if you end up in an accident and the value of the car is less than the loan amount.

This is where gap insurance comes into play.

Auto insurance pays only what a car is worth at the time of a theft or accident. Let’s say, you buy a new car for $30,000 and total it in the first year. The insurance company will only pay what it’s worth on the market. So, if your car has a depreciated value of $24,000 and you owe (say) $27,000 when it’s totaled, the insurance company is only going to pay the financing company $24,000 on your claim. You would be left owing the remainder of the loan — $3,000 in this example.

Gap insurance covers the difference between your car’s current market value and the amount you owe a lender.

Gap insurance only covers the difference between your loan value and the market value in the event of a total loss from theft or an accident. It will not cover you in the following:

- You get in an accident, but your car isn’t totaled. You’ll have to rely on your normal car insurance policy in the event you get in an accident and your vehicle sustains damage. Gap insurance will only cover a car that is beyond repair, or damages that are inordinately expensive to repair.

- You or someone involved in the accident sustains a bodily injury or dies. Gap insurance does not cover bodily injuries, medical expenses, funeral costs, or lost wages as a result of an accident. It only applies to vehicle losses.

- Your engine fails. Gap insurance only covers totaled vehicles, not cars that have died as a result of engine breakdown.

- Additionally, the comprehensive or collision insurance deductible is still your responsibility to pay in the event of an accident, even if you have gap insurance.

When is gap insurance worth it?

It’s a good idea to consider buying gap insurance for your new vehicle purchase if you:

- Made less than a 20 percent down payment

- Financed for 60 months or longer

- Leased the vehicle (carrying gap insurance is generally required for a lease). Some lease companies include Gap insurance in the lease. Make sure you check with the dealer for confirmation.

- Purchased a vehicle that depreciates faster than the average

- Rolled over negative equity from an old car loan into the new loan

When is gap insurance not worth it?

Your lease terms may require you to carry gap insurance as long as you have the automobile. But if you finance a car, you don’t need to carry gap insurance for the entire loan term. When the amount you owe is less than the actual cash value of the vehicle, you can discontinue gap insurance coverage.

And if you pay cash for an automobile, you don’t need gap insurance.

How much does gap insurance cost?

When you first purchase your vehicle, your car dealer may offer to sell you gap insurance on it. Your auto insurance company may offer it as well.. On most auto insurance policies, including gap insurance to your collision and comprehensive coverage will only add about $20 to your annual premium.

How long do I need gap coverage for?

- You’ve paid off your loan. No gap? No gap insurance necessary.

- Your car value is close to the loan balance. After one to two years, the amount you owe on your vehicle should be less than the vehicle’s worth. you should be safe to cancel your gap insurance.

- Since gap insurance from dealers is usually paid for up front, you’ll qualify for a refund if you sell or refinance your vehicle.